Help to Buy

CHANGES FROM 1 APRIL 2021

Help to Buy: Equity Loan is a loan from the government that you put towards the cost of buying a newly built home. Help to Buy aims to help first-time buyers to get on the property ladder. If you’re eligible for an equity loan, you can borrow up to 20% (40% if you’re in London) of the market value of a new home. When you take out an equity loan, you only pay interest on the amount you borrowed. You should be aware that the interest payments you make do not go towards repaying your equity loan. You cannot make monthly repayments to reduce your loan. But you can choose to repay it all or in part at any time. If you sell your home, you will need to repay all of your equity loan.

You can only apply for Help to Buy if you reserve your new home with a Help to Buy registered homebuilder.

WHAT IS HELP TO BUY?

Own 100% of your home.

With an equity loan, the Government will lend you a minimum of 5% and up to 20% (or up to 40% in London) of the market value of your newly built home. The amount you can spend on the home depends on where in England you buy it.

The maximum property price is the full purchase price. You cannot change or negotiate this price. Your homebuilder will be able to confirm if the home you want to buy is within the price range. You must:

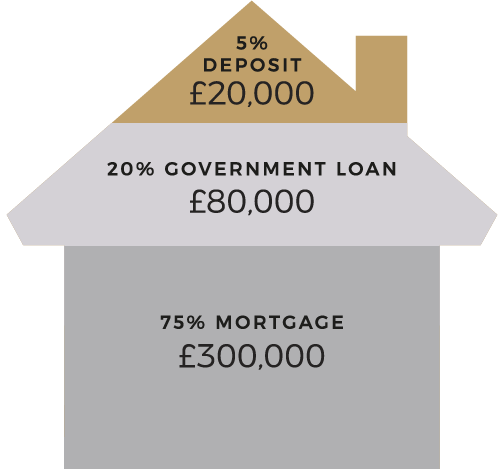

• pay a deposit of 5% of the purchase price of your new home at exchange of contracts

• arrange a repayment mortgage of at least 25% of the purchase price of your new home. An equity loan is secured against your property in the same way a repayment mortgage is. The Help to Buy: Equity Loan scheme is not regulated by the Financial Conduct Authority (FCA).

Brentwood sits in the East of England region and from 1 April 2021 the maximum property price is £407,400.

HOW DOES IT WORK?

Through Help to Buy: Equity Loan homebuyers with a minimum of 5% deposit will be eligible to receive an interest free equity loan from the government of up to 20% of the value of their new home, leaving them only needing to secure up to a 75% mortgage from a bank or building society.

The equity loan must be repaid after 25 years, or earlier if you sell your property and is interest free for the first five years. From year six a fee of 1.75% is payable on the equity loan, which rises annually by RPI inflation plus 1%.

WHO’S ELIGIBLE?

The scheme is available to only first-time buyers from 1 April 2021 on new-build properties up to a maximum value of £407,400.

Help to Buy: Equity Loan is available to homebuyers regardless of their annual personal income with mortgages available from a number of high street lenders.

Help to Buy is subject to terms and conditions.

Please visit helptobuy.gov.uk for more information